The Economic Substance Regulations (ESR) in the UAE are a set of regulations introduced to ensure that companies have a substantial economic presence in the country by conducting real economic activities and maintaining adequate levels of staffing, expenditure, and physical presence. These regulations were introduced to align with international standards and to prevent profit shifting […]

Tag Archives: UAE VAT LAW

🌐 Locations: Dubai (UAE), Ahmedabad (India) 📊 Services: Accounting, Bookkeeping, Tax, and More Discover the benefits of choosing Al Marzaan Consultancy as your accounting partner. We offer a wide array of accounting services in multiple locations. Our tailored solutions empower you to select the services that best suit your needs, helping you gain control over […]

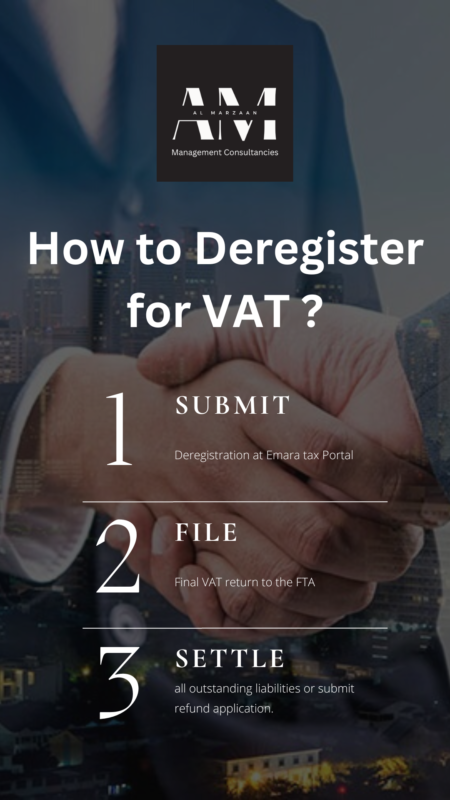

Our VAT deregistration services helping eligible businesses smoothly cancel their VAT registrations. VAT deregistration, or the termination of VAT registration, is a crucial process when a business needs to cancel its VAT registration with the Tax Authority, and it’s typically done online. Types of VAT Deregistration 1) Mandatory VAT Deregistration 2) Voluntary VAT Deregistration VAT […]

Al Marzaan Consultancy is your trusted partner for VAT refund services in the UAE catering to both businesses and tourists seeking swift VAT refunds. This service becomes relevant when your input VAT is greater than your output VAT. To clarify, the output tax pertains to the tax imposed on a business’s sales, while the input […]

Al Marzaan is providing all types of VAT registration services in UAE such as voluntary VAT registration or mandatory VAT registration. Since its inception, AL MARZAAN has been a major business consultant, providing accounting and tax services to commercial businesses on a global basis. Our VAT experts will assist your business with VAT registration procedure and structure it […]

Article (64) – Adjustments of Bad Debts under UAE VAT Law The VAT Law makes provisions for a bad debt write-off and discount of output tax paid on a supply for which consideration has not been received, either fully or in part after 6 months from the date of the supply. Certain conditions must be […]

Are you a UAE Exempt Supply Dealer and Confused About VAT Refunds? Our Comprehensive Article Guides You Through the Process Step-by-Step. Don’t Miss Out on Reclaiming Your Input Goods VAT!