Corporate tax return filing in the UAE is a critical requirement for companies, as per the tax laws set by the Federal Tax Authority (FTA). Here’s a summary of the key aspects of corporate tax return filing in the UAE: What is Corporate Tax Return Filing in UAE? Corporate tax return filing in the UAE […]

Category Archives: Taxation

Transfer Pricing in UAE Documentation and Its Importance: Transfer pricing documentation in the United Arab Emirates (UAE) is a crucial aspect of corporate tax compliance. It plays a pivotal role in helping companies determine their tax liabilities when filing corporate tax returns. These documents have a significant impact on the amount of taxable income declared […]

Corporate Tax Impact Assessment is a methodical process that examines how corporate tax impacts businesses. It allows for strategic adjustments within a company or group before tax obligations arise. Al Marzaan Consultancy has a skilled team of corporate tax specialists in the UAE, well-equipped to provide corporate tax impact assessment services, ensuring tax compliance. Our […]

In the dynamic landscape of the UAE’s financial sector, Al Marzaan stands as your trusted provider of corporate tax services. It’s essential for businesses to understand the corporate tax law and its registration procedures. Here’s your comprehensive guide: In 2022, the UAE’s Ministry of Finance introduced Corporate Tax, slated for full implementation in June 2023, […]

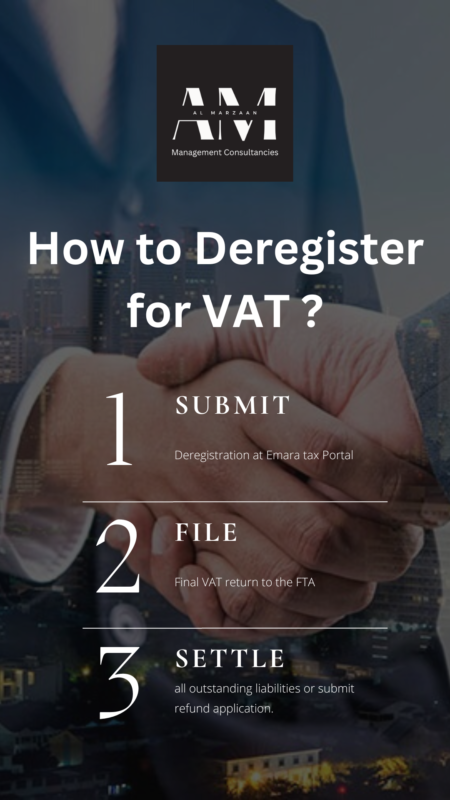

Our VAT deregistration services helping eligible businesses smoothly cancel their VAT registrations. VAT deregistration, or the termination of VAT registration, is a crucial process when a business needs to cancel its VAT registration with the Tax Authority, and it’s typically done online. Types of VAT Deregistration 1) Mandatory VAT Deregistration 2) Voluntary VAT Deregistration VAT […]

Our VAT audit services, available in UAE offer a comprehensive and meticulous examination of an entity’s VAT accounting and VAT return filing. It’s crucial for all VAT-registered businesses to be well-prepared for VAT audits, as these audits assess VAT liability by scrutinizing accounting records, bookkeeping practices, and VAT return submissions. We’ve observed a growing interest […]

Al Marzaan Consultancy is your trusted partner for VAT refund services in the UAE catering to both businesses and tourists seeking swift VAT refunds. This service becomes relevant when your input VAT is greater than your output VAT. To clarify, the output tax pertains to the tax imposed on a business’s sales, while the input […]

VAT Return Filing Services in offer comprehensive VAT services with expert professionals to take care of all your VAT affairs and transactions. VAT return filing is an integral component of the VAT system used for the purpose of reporting the VAT collected and paid by the entity to the tax authority during the given specific time […]

Al Marzaan is providing all types of VAT registration services in UAE such as voluntary VAT registration or mandatory VAT registration. Since its inception, AL MARZAAN has been a major business consultant, providing accounting and tax services to commercial businesses on a global basis. Our VAT experts will assist your business with VAT registration procedure and structure it […]

If you are carrying out any of the following businesses and Professions in UAE then you must know what AML is….

1. Dealers in precious metals and Stones

2. Real Estate Agents and Brokers

3. Trusts and Corporate Services Providers

4. Auditors and Independent Accountants

5. Lawyers, Notaries and Other Legal Professionals

- 1

- 2