Our VAT deregistration services helping eligible businesses smoothly cancel their VAT registrations. VAT deregistration, or the termination of VAT registration, is a crucial process when a business needs to cancel its VAT registration with the Tax Authority, and it’s typically done online.

Types of VAT Deregistration

1) Mandatory VAT Deregistration

- When a taxable entity no longer conducts economic activities.

- If the business ceases making taxable supplies.

- When the entity is no longer a legal entity (e.g., company closure).

2) Voluntary VAT Deregistration

- When the value of taxable sales in the past 12 months falls between the voluntary and mandatory thresholds.

- When the projected value of taxable sales for the next 12 months (including the current month) falls within the voluntary to mandatory thresholds.

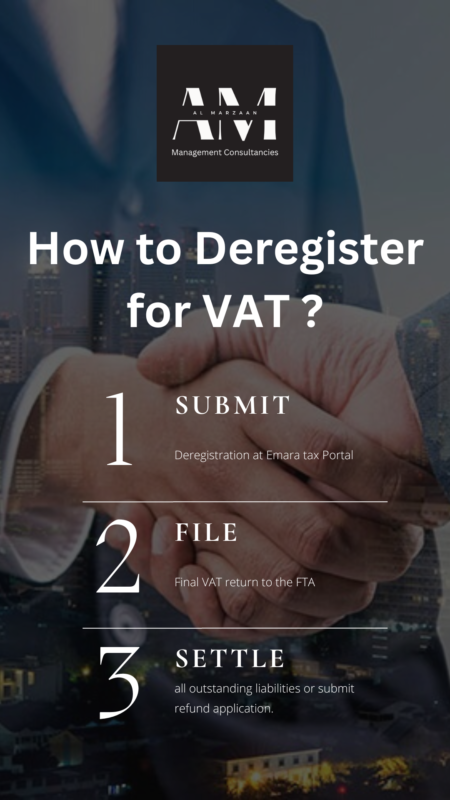

VAT Deregistration Procedure

- Prepare Required Documents: Collect necessary documents like VAT Deregistration Application Form, Emirates ID, passport of the authorized signatory, a deregistration request letter with reasons, supporting evidence, VAT invoices, financial statements, and customs registration cancellation certificate if applicable.

- Settle Outstanding VAT Liability: Clear any outstanding VAT tax invoices and credit notes.

- Submit Application: Complete the VAT Deregistration Application Form and submit it, along with the required documents, via the Emara Tax portal to the Federal Tax Authority (FTA).

- Await Approval: The FTA reviews the application, may request additional information, and, upon approval, issues a VAT deregistration certificate.

- Update Records: Update business records and systems to reflect the VAT deregistration status, including accounting systems and invoices.

Significance of VAT Deregistration

VAT deregistration is crucial for compliance, as failure to apply within specified timeframes may result in penalties. Understanding the rules and process for VAT cancellation in multiple countries is essential.

How Al Marzaan Consultancy Can Help

Al Marzaan offers VAT deregistration services and a range of business services, including CFO services, audit services, accounting and bookkeeping, VAT registration, and VAT filing. We provide expert VAT consultation and support for your business needs. Contact Al Marzaan Consultancy for a free VAT consultation to address any uncertainties. We’re here to assist you!