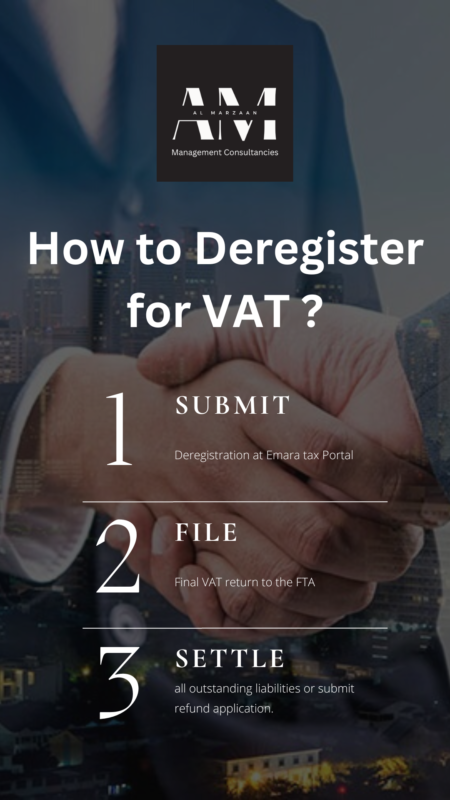

Our VAT deregistration services helping eligible businesses smoothly cancel their VAT registrations. VAT deregistration, or the termination of VAT registration, is a crucial process when a business needs to cancel its VAT registration with the Tax Authority, and it’s typically done online. Types of VAT Deregistration 1) Mandatory VAT Deregistration 2) Voluntary VAT Deregistration VAT […]

Author Archives: Zaid Shaikh

Our VAT audit services, available in UAE offer a comprehensive and meticulous examination of an entity’s VAT accounting and VAT return filing. It’s crucial for all VAT-registered businesses to be well-prepared for VAT audits, as these audits assess VAT liability by scrutinizing accounting records, bookkeeping practices, and VAT return submissions. We’ve observed a growing interest […]

Al Marzaan Consultancy is your trusted partner for VAT refund services in the UAE catering to both businesses and tourists seeking swift VAT refunds. This service becomes relevant when your input VAT is greater than your output VAT. To clarify, the output tax pertains to the tax imposed on a business’s sales, while the input […]

VAT Return Filing Services in offer comprehensive VAT services with expert professionals to take care of all your VAT affairs and transactions. VAT return filing is an integral component of the VAT system used for the purpose of reporting the VAT collected and paid by the entity to the tax authority during the given specific time […]

Al Marzaan is providing all types of VAT registration services in UAE such as voluntary VAT registration or mandatory VAT registration. Since its inception, AL MARZAAN has been a major business consultant, providing accounting and tax services to commercial businesses on a global basis. Our VAT experts will assist your business with VAT registration procedure and structure it […]

If you are carrying out any of the following businesses and Professions in UAE then you must know what AML is….

1. Dealers in precious metals and Stones

2. Real Estate Agents and Brokers

3. Trusts and Corporate Services Providers

4. Auditors and Independent Accountants

5. Lawyers, Notaries and Other Legal Professionals

About Dealers in Precious Metals and Stones Report (DPMSR) The Ministry of Economy issued Circular No. 08/AML/2021 dated 02 June 2021, which introduces a new requirement for dealers involved in the trade of Precious Metals and Stones. This circular mandates the registration of specific transactions, including cash transactions or transactions conducted through wire transfers (for […]

Article (64) – Adjustments of Bad Debts under UAE VAT Law The VAT Law makes provisions for a bad debt write-off and discount of output tax paid on a supply for which consideration has not been received, either fully or in part after 6 months from the date of the supply. Certain conditions must be […]

Are you a UAE Exempt Supply Dealer and Confused About VAT Refunds? Our Comprehensive Article Guides You Through the Process Step-by-Step. Don’t Miss Out on Reclaiming Your Input Goods VAT!

Attention UAE Real Estate Experts! Stay Informed on the Mandatory Real Estate Activity Report. Our Comprehensive Article Covers Everything You Need to Know.