🌍 Locations: Dubai (UAE), Ahmedabad (India) 💼 Tailored Solutions: Enhance Business Efficiency At Al Marzaan Consultancy, we offer a diverse range of Payroll services across multiple countries to optimize your business operations. Our dedicated payroll professionals are skilled in aligning resources with strategic goals and improving overall efficiency. We evaluate your existing processes and recommend […]

Tag Archives: UAE

Accounting Services in Dubai and Ahmedabad 🌐 Locations: Dubai (UAE), Ahmedabad (India)📊 Services: Accounting, Bookkeeping, Tax, and More Discover the benefits of choosing Al Marzaan Consultancy as your accounting partner. We offer a wide array of accounting services in multiple locations. Our tailored solutions empower you to select the services that best suit your needs, […]

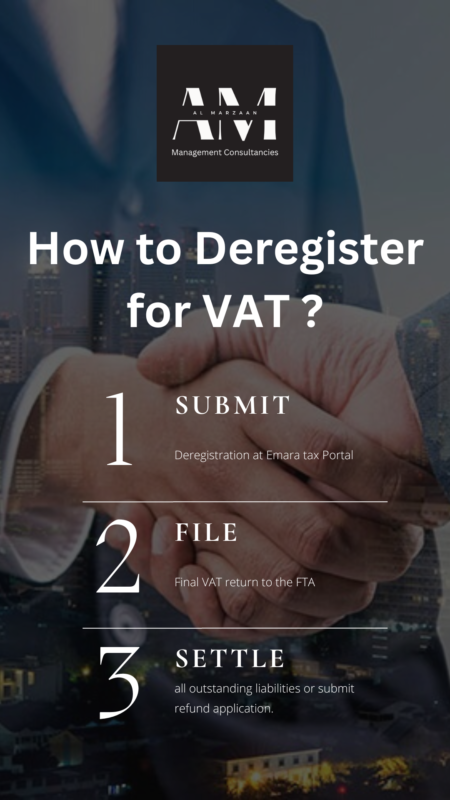

Our VAT deregistration services helping eligible businesses smoothly cancel their VAT registrations. VAT deregistration, or the termination of VAT registration, is a crucial process when a business needs to cancel its VAT registration with the Tax Authority, and it’s typically done online. Types of VAT Deregistration 1) Mandatory VAT Deregistration 2) Voluntary VAT Deregistration VAT […]

Al Marzaan Consultancy is your trusted partner for VAT refund services in the UAE catering to both businesses and tourists seeking swift VAT refunds. This service becomes relevant when your input VAT is greater than your output VAT. To clarify, the output tax pertains to the tax imposed on a business’s sales, while the input […]

VAT Return Filing Services in offer comprehensive VAT services with expert professionals to take care of all your VAT affairs and transactions. VAT return filing is an integral component of the VAT system used for the purpose of reporting the VAT collected and paid by the entity to the tax authority during the given specific time […]

Al Marzaan is providing all types of VAT registration services in UAE such as voluntary VAT registration or mandatory VAT registration. Since its inception, AL MARZAAN has been a major business consultant, providing accounting and tax services to commercial businesses on a global basis. Our VAT experts will assist your business with VAT registration procedure and structure it […]

Article (64) – Adjustments of Bad Debts under UAE VAT Law The VAT Law makes provisions for a bad debt write-off and discount of output tax paid on a supply for which consideration has not been received, either fully or in part after 6 months from the date of the supply. Certain conditions must be […]

Are you a UAE Exempt Supply Dealer and Confused About VAT Refunds? Our Comprehensive Article Guides You Through the Process Step-by-Step. Don’t Miss Out on Reclaiming Your Input Goods VAT!

Attention UAE Real Estate Experts! Stay Informed on the Mandatory Real Estate Activity Report. Our Comprehensive Article Covers Everything You Need to Know.

- 1

- 2