As part of the UAE government’s efforts to fight these financial crimes, AML/CFT regulations have been issued, supported by the detailed guidelines issued by various supervisory Authorities, laying down the principles and best practices necessary to identify the financial crime instances and mitigate the risks.

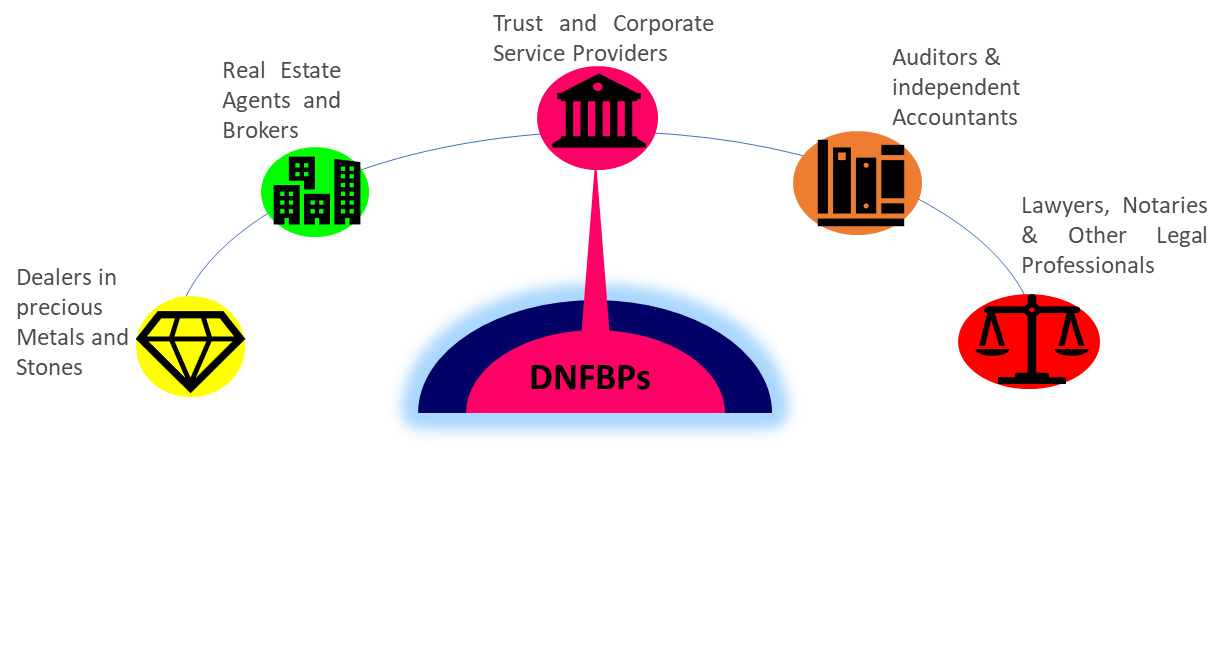

Here is the comprehensive guide to Anti-Money Laundering (AML) Laws in UAE for DNFBPs. The AML Law in UAE applies to financial institutions, banks, insurance companies, Designated Non-Financial Businesses and Professions, and Virtual Asset Services Providers (VASPs). These Designated Non-Financial Businesses and Professions (DNFBPs) include:

Here is the checklist of the core AML/CFT obligations entrusted upon the DNFBPs by the UAE AML Laws:

- Have you got yourself registered with goAML Portal?

- Do you have a competent AML Compliance Officer to manage your compliance?

- Have you identified and assessed your business’s exposure to ML/FT risks?

- Are your AML/CFT policies, procedures, and controls effective and aligned with AML/CFT laws .

- Is your Customer Due Diligence process well-defined?

- Is your implementation of Targeted Financial Sanctions (TFS) effective?

- Have you assessed your customer’s risk, considering relevant risk factors?

- How do you do your Politically Exposed Person Screening?

- Are your process robust enough to identify various local and international PEP’s?

- If classified as “high-risk”, what Enhanced Due Diligence measures do you apply?

- Do you have a set process to identify and report Suspicious Transactions and other relevant reports on the Go-AML Portal?

- Do you retain all your AML/CFT records for at least 5 years?

- Do you comply file STR/SAR when required?